The Complete Guide to Infrastructure Ownership: Why Direct Banking Relationships Beat Middleware

By Darin Petty, Co-Founder & CEO, Chisel | 14 min read

Table of Contents

Introduction

The era of rented infrastructure is over. Recent industry challenges have exposed the fundamental limitations of middleware models, creating an infrastructure reckoning that no fintech can afford to ignore.

For the past five years, the "Banking-as-a-Service" (BaaS) middleware model promised speed and simplicity. It delivered vendor lock-in, opaque compliance failures, and ultimately, existential risk. We know this because we've been in the trenches. We built infrastructure systems for over a decade. We've seen what works and what doesn't.

The writing on the wall is clear: regulatory shifts, infrastructure incidents, and middleware consolidation have created a perfect storm that demands a new approach. Fintech infrastructure ownership isn't just the future—it's the present for companies serious about long-term success.

What This Guide Covers:

- What infrastructure ownership really means and why it matters now

- The Direct Member Ownership (DMO) model that's replacing middleware dependency

- Complete business case analysis with real cost comparisons

- Technical architecture considerations for composable fintech infrastructure

- Step-by-step migration strategies from our experience guiding dozens of companies

- The future regulatory and technology landscape

Our Promise: By the end of this guide, you'll understand exactly why leading fintechs are making the shift to owned infrastructure—and have a clear roadmap to get there yourself.

The companies that will dominate the next decade of fintech aren't just building better products. They're building better foundations. Infrastructure ownership is competitive advantage, and the time to act is now.

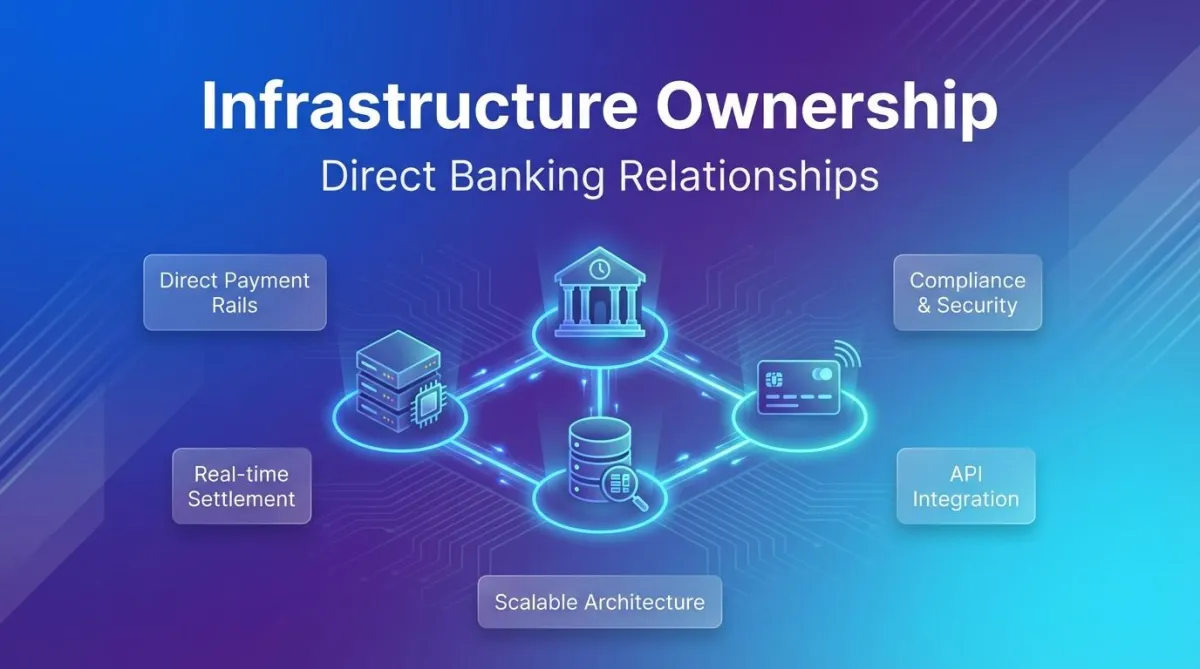

Understanding Infrastructure Ownership

What Is Fintech Infrastructure Ownership?

Fintech infrastructure ownership means removing the intermediaries between your platform and the financial rails. Instead of renting access to someone else's banking relationships, compliance programs, and technology stack, you establish direct commercial and technical relationships with banks, processors, and card networks.

In the traditional middleware model, a BaaS provider sits between you and the actual financial infrastructure, creating layers of markup, dependency, and risk. You're essentially renting desk space in someone else's office—convenient initially, but limiting as you grow.

Infrastructure ownership flips this model. You become the primary relationship holder with the bank. You negotiate directly with processors. You maintain your own compliance program. You control your own technology stack and data.

The Evolution from Middleware to Ownership

The BaaS middleware model emerged to solve a real problem: the complexity of building financial infrastructure from scratch. For early-stage fintechs, middleware provided a path to market without the overhead of bank partnerships, compliance programs, and technical infrastructure.

The Promise Was Simple:

- Faster time to market

- Reduced regulatory complexity

- Outsourced compliance management

- Plug-and-play banking functionality

The Reality Proved More Complex:

- Hidden costs that compound with scale

- Limited product customization options

- Third-party risk concentration

- Vendor lock-in with expensive migration costs

- Opacity in compliance and risk management

Recent industry challenges have accelerated the recognition that middleware creates more risk than it eliminates. Regulatory scrutiny has intensified. Banks are increasingly cautious about third-party risk. The cost of middleware dependency has become clear.

Smart fintechs aren't just planning for infrastructure ownership—they're actively migrating.

The Direct Member Ownership (DMO) Model Explained

Direct Member Ownership (DMO) is our framework for fintech infrastructure ownership that eliminates middleware dependencies while maintaining operational efficiency.

Key Components of DMO:

Banking Partner (Direct Relationship)

- Sponsor bank relationship in your name

- Direct regulatory oversight and communication

- Transparent economics and contract termsProcessor Direct Connection

- Commercial relationship directly with Galileo, Marqeta, Tabapay, or other processors

- Access to full feature sets and roadmaps

- Volume-based pricing negotiationsCard Network Membership

- BIN sponsorship arrangements with Visa/Mastercard

- Direct access to network features and programs

- Settlement processes you controlCore Banking System

- Ledger and account management technology you operate

- Customer data and transaction history you own

- Customization capabilities unlimited by middleware constraintsCompliance & Risk Management

- BSA/AML program you design and operate

- KYC procedures optimized for your customer base

- Transaction monitoring rules you configure

Own vs. Rent: The Fundamental Difference

Control - Limited to middleware capabilitiesUnlimited customization

Costs - Transaction markups + feesDirect processor costs

Speed - Weeks/months for new featuresDays/weeks for any feature

Compliance - Inherit third-party programDesign your own program

Risk - Hidden upstream dependenciesTransparent, manageable risk

Data - Limited access and portabilityComplete ownership and control

The difference isn't just operational—it's strategic. Middleware keeps you in a perpetual state of dependency. Infrastructure ownership gives you the foundation to build sustainable competitive advantage.

The Bottom Line: Renting made sense when you needed to move fast and infrastructure was hard to build. Today, with modern tools and experienced partners, ownership is both accessible and essential for long-term success.

The Business Case for Infrastructure Ownership

The Total Cost of Ownership Analysis

The Common Misconception: "Infrastructure ownership is expensive."

The Financial Reality: At scale, ownership becomes significantly cheaper than middleware, typically within 24 months.

5-Year Cost Trajectory:

Year 1: Higher setup costs vs. middleware (infrastructure investment, team building)

Year 2-3: Costs converge as efficiencies kick in

Year 4-5: Ownership costs 40-60% less than middleware equivalent

This isn't theory—it's based on actual migrations we've guided. The crossover point varies by transaction volume and product complexity, but the pattern is consistent: initial investment, rapid payback, then sustained savings.

Hidden Costs of Middleware Models

The Markup Stack Problem:

Every middleware transaction carries multiple layers of markup:

- Processor fees (2-3% of transaction value)

- Middleware markup (20-40% on top of processor fees)

- Platform fees, monthly minimums, setup costs

- Feature access fees (often charged per transaction)

- Data access and export fees

- Migration penalties when you want to leave

Real Numbers from a $50M TPV Fintech:

- Middleware total annual cost: $2.4M

- Base processor fees: $1.2M

- Middleware markup: $800K

- Platform and feature fees: $400K

- Owned infrastructure annual cost: $1.1M (after migration)

- Direct processor fees: $900K

- Internal team and systems: $200K

- Annual savings after migration: $1.3M

- 5-year total savings: $4.8M (accounting for migration costs)

When Ownership Makes Economic Sense

Break-Even Analysis Framework:

Transaction Volume Thresholds:

- Under $10M annually: Middleware typically more cost-effective

- $10-25M annually: Economics begin favoring ownership

- Over $25M annually: Ownership almost always superior

- Over $100M annually: Ownership essential for competitive margins

Beyond Volume Considerations:

- Product Complexity: Custom features, international capabilities, B2B needs

- Growth Trajectory: Rapid scaling makes early ownership investment valuable

- Strategic Value: Data ownership, customer experience control, competitive moat

Rule of Thumb: If you're processing $25M+ annually or have clear path to that scale within 18 months, the economics favor infrastructure ownership.

Control and Customization Value

The financial case is compelling, but the strategic value often exceeds the cost savings:

Product Velocity Transformation:

- Middleware Reality: 6-12 weeks for new features (if they'll build them)

- Ownership Reality: Days to weeks for any feature you can conceive

Real Example: A client wanted to add spending category controls to their card product. With their previous middleware provider, this was a 6-month roadmap item with no guarantee. After migrating to owned infrastructure, they launched the feature in 3 weeks.

Customer Experience Control:

- Dispute handling workflows you design

- Customer communication you control

- User interfaces with no middleware branding constraints

- Transaction flows optimized for your customer base

Data Ownership and Insights:

- Complete transaction history with unlimited analysis

- Customer behavior patterns middleware providers often restrict

- Real-time data access without API rate limits

- Data portability and backup strategies you control

Speed to Market Advantages

The Innovation Bottleneck:

Middleware providers serve hundreds of clients with competing priorities. Your product roadmap becomes subject to their strategic decisions, development capacity, and business priorities.

Case Study - Card Controls Implementation:

- Middleware approach: Submit feature request → Wait for roadmap review → Hope for development → Accept their implementation

- Ownership approach: Define requirements → Develop or integrate → Test → Deploy → Iterate based on customer feedback

The ownership approach took 3 weeks. The middleware approach took 8 months and delivered a feature that didn't match the original requirements.

Competitive Moat Creation:

When you own your infrastructure, your product differentiation isn't limited by what middleware providers offer everyone else. You can build features that competitors using the same middleware simply cannot access.

This isn't just about cost savings—it's about building sustainable competitive advantage in an increasingly crowded market.

Direct Banking Relationships Explained

What Are Direct Banking Relationships?

Direct banking relationships eliminate the middleware layer between your fintech and the actual financial infrastructure. Instead of being a customer of a middleware provider who has relationships with banks, you become the direct partner with the bank itself.

Traditional BaaS Model:

Your Fintech → Middleware Provider → Bank → Financial Rails

Direct Relationship Model:

Your Fintech → Bank → Financial Rails

This architectural change has profound implications for control, cost, compliance, and capability.

Sponsor Bank Partnerships

The Traditional BaaS Structure:

In the middleware model, the BaaS provider maintains the primary relationship with the sponsor bank. You're essentially a sub-customer, with no direct communication channel, limited visibility into operations, and no influence over the banking relationship strategy.

The Direct Model Transformation:

With direct banking relationships, you become the primary partner with the sponsor bank. This means:

Direct Communication: You speak directly with bank compliance, operations, and management teams

Transparent Economics: You see exactly what the bank charges vs. what you pay

Strategic Influence: You participate in product development and operational decisions

Regulatory Clarity: You own the relationship with examiners and regulatory bodies

What Sponsor Banks Look For:

Modern sponsor banks are increasingly sophisticated in their fintech partnership criteria:

Compliance Infrastructure: Demonstrated BSA/AML program capability

Risk Management: Clear policies and monitoring systems

Technical Competency: Proven ability to integrate and operate financial systems

Management Experience: Leadership team with relevant financial services background

Growth Trajectory: Clear path to meaningful transaction volume

The Relationship Development Process:

Building sponsor bank relationships takes 3-6 months, but the investment pays dividends in operational flexibility and strategic alignment.

Card Network Direct Membership

Understanding BIN Sponsorship:

Bank Identification Numbers (BINs) are issued by card networks (Visa, Mastercard) to banks, which then sponsor fintechs. In the middleware model, you're several degrees removed from network decision-making.

Direct Membership Benefits:

- Feature Access: First access to new network capabilities and programs

- Economic Improvement: Better interchange optimization and network incentives

- Operational Control: Direct settlement processes and dispute management

- Strategic Participation: Input on network policy and program development

Network Requirements:

Both Visa and Mastercard have specific requirements for direct relationships:

- Minimum transaction volume thresholds

- Compliance and risk management standards

- Technical integration capabilities

- Financial stability and reporting

Processor Direct Relationships

The Middleware Markup Problem:

Most middleware providers mark up processor fees by 20-40%, creating significant cost inefficiency at scale. They also limit access to processor features and roadmaps.

Major Processors and Direct Benefits:

Galileo (SoFi Technologies):

- Leading transaction volume and feature set

- Strong international capabilities

- Direct customer support and technical resources

Marqeta (Block):

- Modern API-first architecture

- Strong real-time capabilities

- Flexible spending controls and transaction routing

Tabapay:

- Focus on push-to-card and disbursement products

- Competitive pricing for high-volume clients

- Strong compliance and risk management tools

Direct Relationship Advantages:

- Pricing Transparency: See actual processor costs vs. marked-up middleware pricing

- Feature Access: Access to full processor roadmap and beta programs

- Technical Support: Direct relationship with processor engineering and support teams

- Strategic Partnership: Influence over processor product development priorities

Negotiation Power:

Direct relationships enable volume-based pricing negotiations, custom development opportunities, and priority support that middleware relationships simply cannot provide.

Core Banking System Ownership

The Build vs. Buy Decision:

You don't need to build core banking technology from scratch, but you do need to own and operate it rather than rent access through middleware.

Modern Core Banking Options:

- Thought Machine (Vault): Cloud-native, API-first core banking

- Mambu: SaaS core banking with strong customization

- Technisys (Galileo): Full-stack digital banking platform

- Custom Solutions: Built on modern cloud infrastructure

Key Capabilities You Need:

- Ledger Management: Real-time balance tracking and transaction posting

- Account Management: Customer account lifecycle and product configuration

- Transaction Processing: Payment routing, clearing, and settlement

- Data Management: Customer information, transaction history, reporting

The Strategic Consideration:

You need the capability and control, not necessarily the complexity of building from scratch. Modern core banking platforms provide the foundation for composable fintech infrastructure while giving you the ownership and control that middleware cannot.

Risk & Compliance Advantages

Eliminating Third-Party Risk

The Fundamental Problem with Rented Infrastructure:

When you rely on middleware, you inherit their entire risk profile without visibility or control. Their operational failures become your customer-facing problems. Their compliance issues become your regulatory nightmares.

Third-Party Risk Categories:

1. Operational Risk

Recent industry challenges have shown how quickly middleware provider operational issues cascade to all their clients. System outages, processing delays, and technical failures impact every fintech depending on their infrastructure.

2. Compliance Risk

Middleware compliance failures can result in regulatory action against their bank partners, which directly impacts your ability to serve customers. You're dependent on their compliance program quality without the ability to audit or influence it.

3. Concentration Risk

When hundreds of fintechs depend on the same middleware provider, any significant issue creates industry-wide disruption. This concentration risk is systemic and uninsurable.

4. Reputational Risk

Middleware provider issues generate negative press that affects all their clients. Your brand becomes associated with problems you didn't create and cannot solve independently.

Recent Industry Context:

The fintech industry has experienced significant infrastructure incidents that exposed the vulnerability of dependency models. When middleware providers face regulatory challenges, business model pressures, or operational failures, all their clients face immediate consequences.

These incidents weren't isolated problems—they were predictable outcomes of over-concentration and under-transparency in critical financial infrastructure.

Regulatory Clarity and Direct Oversight

The Compliance Advantage of Direct Relationships:

Banking regulators increasingly favor direct relationships because they provide clearer accountability and more transparent risk management. Recent regulatory guidance emphasizes the importance of:

Clear Operational Control: Direct oversight of critical banking functions

Transparent Risk Management: Visible and auditable risk management processes

Reduced Third-Party Dependencies: Minimized reliance on vendors for critical functions

Direct Accountability: Clear responsibility for compliance program design and execution

Regulatory Perspective Evolution:

Federal banking regulators have issued increasingly pointed guidance about third-party risk management, particularly regarding fintech partnerships. The message is clear: banks and their fintech partners must demonstrate direct control over critical functions.

Benefits of Direct Regulatory Relationships:

- Clear Communication: Direct dialogue with regulatory examination teams

- Transparent Audit Trails: Complete visibility into transaction flows and decision-making

- Strategic Compliance: Compliance program designed for your specific business model

- Proactive Management: Early warning system for regulatory changes affecting your business

Compliance Program Ownership

What You Control with Infrastructure Ownership:

BSA/AML Program Design:

- Customer risk assessment methodologies tailored to your business

- Transaction monitoring rules optimized for your transaction patterns

- Suspicious Activity Report (SAR) processes you design and execute

- Training programs specific to your team and customer base

KYC Procedures:

- Customer onboarding workflows optimized for your user experience

- Enhanced due diligence procedures appropriate for your risk appetite

- Ongoing monitoring systems configured for your customer behavior patterns

- Documentation requirements balanced for compliance and customer experience

Consumer Protection Compliance:

- Regulation E procedures designed for your products and customer base

- Privacy policies and data handling practices you control

- Dispute resolution processes optimized for customer satisfaction

- Communication strategies aligned with your brand and values

Strategic Compliance Advantage:

When you own your compliance program, compliance becomes a competitive asset rather than a bottleneck. You can design processes that meet regulatory requirements while optimizing for customer experience and operational efficiency.

Operational Resilience

System Redundancy and Business Continuity:

Infrastructure ownership enables redundancy strategies that middleware dependency makes impossible:

Multiple Processor Relationships:

- Primary and backup processor arrangements

- Geographic redundancy for disaster recovery

- Load balancing across processors for high availability

- Independent failover capabilities

Data Sovereignty and Control:

- Complete customer data backup and recovery systems

- Transaction history preservation independent of vendor relationships

- Real-time data replication across multiple systems

- Audit trail preservation for regulatory requirements

Business Continuity Planning:

- Recovery procedures you design and test

- Vendor diversification strategies to avoid single points of failure

- Direct relationships with critical infrastructure providers

- Communication plans you control during crisis situations

Quote from Compliance Expert

"The shift toward infrastructure ownership isn't just about economics—it's about risk management. Direct relationships provide clarity that middleware simply cannot offer. When you own your infrastructure, you own your compliance destiny. You can see risks coming, measure them accurately, and manage them proactively instead of reacting to someone else's problems."

— Tyler Ferguson, Head of Compliance, Chisel

The Risk Management Reality:

Middleware doesn't eliminate risk—it obscures it. Direct relationships provide transparency that enables effective risk management. When you can see, measure, and manage risk directly, you make better decisions and build more resilient businesses.

Technical Architecture of Owned Infrastructure

Composable Infrastructure Explained

What Is Composable Architecture?

Composable fintech infrastructure is like financial services Lego blocks. Instead of a monolithic system where everything is bundled together, you assemble best-of-breed components that work together through APIs.

Core Principles of Composable Architecture:

1. Modular Design

Each component serves a specific function and can be optimized independently:

- Core banking for ledger and account management

- Processor integration for payment processing

- KYC/AML systems for compliance management

- Data analytics for customer insights

2. API-First Integration

Everything connects through well-documented APIs:

- Standardized data exchange formats

- Real-time event notification systems

- Flexible query and reporting capabilities

- Secure authentication and authorization

3. Interchangeable Components

Swap providers without rebuilding the entire system:

- Change processors without losing customer data

- Upgrade core banking systems without service disruption

- Add new compliance tools without workflow changes

- Integrate new data sources without system redesign

4. Horizontal Scalability

Add capacity where needed:

- Scale transaction processing independently

- Expand compliance monitoring as volume grows

- Add geographic redundancy selectively

- Optimize performance for specific use cases

The Modular Stack Components

Essential Building Blocks for Composable Infrastructure:

1. Core Banking Layer

- Account Management: Customer account lifecycle, product configuration

- Ledger System: Real-time balance tracking, transaction posting

- Interest Calculation: Automated interest accrual and payment

- Statement Generation: Customer communication and reporting

2. Processor Layer

- Card Issuing: Physical and virtual card provisioning and management

- ACH Processing: Direct deposit, bill pay, account-to-account transfers

- Wire Transfers: Domestic and international wire capabilities

- Real-Time Payments: FedNow and RTP network access

3. Card Network Layer

- Authorization Routing: Transaction approval and decline logic

- Settlement Processing: Daily settlement and reconciliation

- Network Compliance: Visa and Mastercard rule adherence

- Chargeback Management: Dispute processing and resolution

4. KYC/AML Layer

- Identity Verification: Document verification and biometric matching

- Risk Scoring: Customer and transaction risk assessment

- Ongoing Monitoring: Behavioral analysis and anomaly detection

- Regulatory Reporting: SAR filing and regulatory communication

5. Data and Analytics Layer

- Transaction History: Searchable transaction database with unlimited retention

- Customer Analytics: Spending patterns, financial health indicators

- Reporting Infrastructure: Real-time dashboards and scheduled reports

- Data Export: Customer data portability and backup systems

API-First Architecture Patterns

Why API-First Architecture Matters:

Flexibility and Vendor Independence:

- Ability to change component providers without system redesign

- Integration with best-of-breed tools as they become available

- Future-proofing against technology changes

- Reduced vendor lock-in and migration risk

Better Developer Experience:

- Standardized integration patterns across all components

- Comprehensive documentation and testing tools

- Modern development frameworks and debugging capabilities

- Faster integration of new features and capabilities

Integration Patterns for Financial Services:

RESTful APIs for Standard Operations:

- Account creation, modification, and closure

- Transaction posting and inquiry

- Customer information management

- Product configuration and pricing

Webhooks for Real-Time Events:

- Transaction authorizations and settlements

- Account balance changes and alerts

- Compliance monitoring and flagging

- Customer lifecycle events

GraphQL for Flexible Data Queries:

- Customer dashboard data assembly

- Administrative reporting and analytics

- Third-party integration data provision

- Mobile app data optimization

Batch Processing for High-Volume Operations:

- End-of-day settlement and reconciliation

- Monthly statement generation

- Regulatory reporting and compliance

- Data backup and archival

Developer Experience Advantages

Speed of Development with Owned Infrastructure:

Custom Feature Development:

- Add new product features in days or weeks, not months

- No dependency on middleware provider roadmaps or priorities

- Direct access to all system capabilities and data

- Modern development tools and frameworks

Technical Debt Comparison:

Middleware Model Technical Constraints:

- Locked into middleware provider's architectural decisions

- Limited customization within their framework

- Feature requests subject to their business priorities

- Version upgrades on their timeline, not yours

- Integration patterns dictated by their API limitations

Owned Infrastructure Technical Freedom:

- Architectural decisions optimized for your use cases

- Unlimited customization within regulatory constraints

- Build exactly what your customers need

- Controlled technical evolution and upgrade cycles

- Choose integration patterns that work for your team

Real-World Development Example:

A client wanted to implement dynamic spending limits based on account balance and spending velocity. With middleware, this would have required a complex feature request with uncertain delivery timeline. With owned infrastructure, they implemented it in two weeks using their existing API architecture and deployed it gradually to test customer response.

Scalability Considerations

Horizontal Scaling Strategies:

Processing Capacity:

- Add additional processor relationships for redundancy

- Load balance transactions across multiple systems

- Geographic distribution for latency optimization

- Peak capacity planning for high-volume periods

Geographic Expansion:

- Add new BIN sponsorship relationships for international markets

- Localize compliance programs for different regulatory environments

- Optimize data residency for privacy regulations

- Scale customer support across time zones

Product Diversification:

- Add new banking products without infrastructure redesign

- Integrate fintech and traditional banking capabilities

- Support B2B and B2C products on same platform

- Cross-sell additional services to existing customer base

Performance Optimization:

Direct Database Access:

- Custom indexing strategies for your query patterns

- Real-time analytics without API rate limits

- Batch processing optimization for your data volume

- Query performance tuning for your specific use cases

Caching and Load Balancing:

- Application-level caching strategies you control

- Content delivery networks optimized for your user base

- Load balancing algorithms tuned for your traffic patterns

- Infrastructure rightsizing based on actual usage data

The Bottom Line on Technical Architecture:

Composable fintech infrastructure isn't just more flexible than middleware—it's more performant, more scalable, and more aligned with modern software development practices. The initial complexity is offset by long-term development velocity and operational efficiency.

Migration Path from BaaS to Ownership

Assessment Framework

Before You Start: Critical Questions

Not every fintech is ready for infrastructure ownership, and timing matters. Answer these questions honestly before beginning the migration process:

1. Transaction Volume and Growth

- Current annual processing volume?

- Growth rate over the past 12 months?

- Projected volume in 24 months?

- Volume concentration (steady or seasonal)?

2. Customer Base and Products

- Total active customers?

- Average customer transaction frequency?

- Product complexity (simple cards vs. multi-product suite)?

- Customer acquisition cost and lifetime value?

3. Technical Team Capacity

- Current engineering team size?

- Experience with financial services integrations?

- DevOps and infrastructure management capabilities?

- Available bandwidth for 6-9 month migration project?

4. Compliance and Operations Readiness

- Dedicated compliance resources?

- Current BSA/AML program maturity?

- Risk management frameworks in place?

- Regulatory examination experience?

5. Business Strategy and Timeline

- Executive commitment to infrastructure ownership?

- Acceptable timeline for migration (6-9 months)?

- Available budget for migration and ongoing operations?

- Strategic importance of infrastructure control?

Readiness Scorecard:

- [ ] $25M+ annual processing volume or clear path within 18 months

- [ ] Technical team of 5+ engineers with fintech experience

- [ ] Dedicated compliance officer or equivalent expertise

- [ ] Executive commitment and migration budget approved

- [ ] 6-12 month timeline acceptable for business objectives

Migration Decision Matrix:

If you checked fewer than 3 boxes, consider staying with middleware until readiness improves. If you checked 4-5 boxes, infrastructure ownership migration is likely strategically and operationally viable.

Migration Timeline Expectations

Realistic Phase-by-Phase Timeline:

Phase 1: Planning & Design (6-8 weeks)

Week 1-2: Strategic Planning

- Executive alignment on objectives and success criteria

- Budget approval and resource allocation

- Project timeline and milestone definition

Week 3-4: Architecture Design

- Current state analysis and technical documentation

- Target state architecture design

- Vendor evaluation and selection criteria

Week 5-6: Vendor Selection

- Bank partner identification and initial discussions

- Processor evaluation and contract negotiation

- Core banking platform selection

Week 7-8: Contract Negotiations

- Banking partnership agreement finalization

- Processor contract terms and pricing

- Technology vendor agreements and service levels

Phase 2: Infrastructure Setup (8-12 weeks)

Week 1-4: Banking Partnership Establishment

- Due diligence and documentation submission

- Compliance program review and approval

- Regulatory notifications and approvals

Week 5-8: Technical Integration

- Core banking system implementation

- Processor API integration and testing

- Data migration planning and preparation

Week 9-12: Compliance Implementation

- BSA/AML system configuration

- Transaction monitoring rule development

- Staff training and procedure documentation

Phase 3: Parallel Processing (4-8 weeks)

Week 1-2: Shadow Processing Setup

- Parallel system configuration

- Data feed establishment and validation

- Monitoring and alerting system activation

Week 3-4: Validation and Testing

- Transaction-by-transaction comparison

- Performance testing under load

- Error handling and edge case validation

Week 5-8: Performance Tuning

- System optimization based on test results

- Staff training on new systems and procedures

- Customer communication planning and preparation

Phase 4: Customer Migration (2-4 weeks)

Week 1: New Customer Migration

- Route new customers to owned infrastructure

- Monitor system performance and customer experience

- Resolve any immediate issues or configuration problems

Week 2-4: Existing Customer Migration

- Phased migration by customer cohort

- Communication to customers about transition

- Intensive monitoring and customer support

Phase 5: Optimization (Ongoing)

- Performance monitoring and system tuning

- Feature development and capability expansion

- Cost optimization and process refinement

- Continuous improvement based on operational experience

Total Timeline: 6-9 months typical

Change Management Considerations

Internal Stakeholder Management:

Engineering Team Preparation

- New system architecture training

- API documentation and integration guides

- DevOps process changes for direct infrastructure management

- Performance monitoring and alerting system training

Compliance Team Training

- New BSA/AML system configuration and management

- Direct regulatory relationship management

- Transaction monitoring and investigation procedures

- Regulatory reporting and documentation requirements

Operations Team Readiness

- Customer support procedures for new infrastructure

- Issue escalation and resolution processes

- System monitoring and incident response procedures

- Vendor relationship management for multiple providers

Executive Alignment

- Regular progress reporting and milestone reviews

- Risk mitigation planning and contingency procedures

- Budget management and cost tracking

- Strategic communication and stakeholder updates

Parallel Processing Strategies

The Safe Migration Approach:

Running both middleware and owned infrastructure simultaneously during migration reduces risk and builds confidence:

Shadow Processing Implementation:

- Route all transactions through both systems

- Compare results transaction-by-transaction

- Identify and resolve discrepancies before customer impact

- Build operational confidence with new systems

Validation Procedures:

- Balance reconciliation between systems

- Transaction timing and performance comparison

- Customer experience monitoring and feedback

- Error rate tracking and resolution

Risk Mitigation:

- Maintain rollback capability throughout migration

- Customer communication planning for any issues

- Intensive monitoring during transition periods

- Support team preparation for increased complexity

Go-Live Strategies

Phased Approach (Recommended):

New Customer First:

- Route new customers to owned infrastructure

- Monitor system performance with controlled volume

- Refine processes based on real-world experience

- Build team confidence before existing customer migration

Cohort-Based Migration:

- Migrate existing customers in small groups

- Monitor each cohort for issues before continuing

- Allow time for customer support and issue resolution

- Maintain detailed migration tracking and rollback capability

Communication Strategy:

- Transparent customer communication about infrastructure improvements

- Support team training on migration-related questions

- Proactive outreach for high-value customers

- Feedback collection and response processes

Big Bang Approach (Higher Risk):

Some organizations prefer to migrate all customers simultaneously to minimize transition complexity. This approach requires:

- Exceptional confidence in new systems

- Extensive testing and validation

- Comprehensive rollback planning

- Intensive monitoring and support resources

The Bottom Line on Migration:

Infrastructure ownership migration is complex but manageable with proper planning, experienced guidance, and phased execution. The key is balancing speed with risk management, ensuring that customer experience remains positive throughout the transition.

Common Objections Addressed

"Infrastructure Ownership Is Too Expensive"

The Objection:

"The upfront costs are too high for our current stage. We can't afford the infrastructure investment, team expansion, and migration costs."

The Financial Reality:

Break-Even Analysis:

Most fintechs achieve break-even on infrastructure ownership investment within 18-24 months, followed by sustained cost savings of 40-60% compared to middleware.

Detailed Cost Comparison for $40M Annual Processing Volume:

Year 1 (Migration Year):

- Middleware costs: $2.2M

- Migration costs: $800K (one-time)

- Ongoing owned infrastructure: $900K

- Net Year 1 cost: $1.7M vs. $2.2M middleware

Years 2-5 (Steady State):

- Annual middleware costs: $2.4M (growing with volume)

- Annual owned infrastructure: $1.1M (more efficient scaling)

- Annual savings: $1.3M

- 5-year total savings: $4.5M

Strategic Value Beyond Cost:

- Product development velocity (features in weeks vs. months)

- Customer experience differentiation

- Data ownership and analytics capabilities

- Competitive moat through infrastructure control

Financing Options:

- Phased migration to spread costs over time

- Revenue-based financing for growth-stage companies

- Partnership with infrastructure specialists (like Chisel) to reduce upfront investment

"It's Too Complex for Our Team"

The Objection:

"We don't have the expertise to manage financial infrastructure. Our team is focused on product development, not infrastructure operations."

The Complexity Reality:

Modern Infrastructure is More Accessible:

Cloud-native banking platforms, API-first architectures, and DevOps automation have dramatically reduced the complexity of infrastructure operations compared to legacy systems.

Team Requirements (Realistic):

- 1-2 additional engineers with fintech experience

- 1 dedicated compliance officer

- Vendor relationships with clear support and documentation

- Partnership with experienced migration specialists

"Black Box" vs. "Your System" Comparison:

- Middleware complexity: Learning someone else's undocumented system quirks

- Owned infrastructure complexity: Learning your own system that you designed

The Truth About Complexity:

Managing owned infrastructure is often less complex than navigating middleware limitations, API constraints, and vendor dependencies. You learn your own system once, rather than constantly adapting to someone else's changes.

Support and Partnership Options:

- Infrastructure-as-a-Service providers (like Chisel) offer managed services

- Core banking platform vendors provide extensive support and documentation

- Processor relationships include technical support and integration assistance

- Industry expertise is increasingly available through consultants and service providers

"Migration Takes Too Long"

The Objection:

"We can't afford 12+ months of migration time. Our business moves too fast, and we need to focus on growth, not infrastructure projects."

The Timeline Reality:

Actual Migration Timeline: 6-9 months for most fintechs, with business operations continuing normally throughout the process.

Parallel Processing Approach:

Your existing business continues operating on middleware while new infrastructure is built and tested. Customer impact is minimal until the final cutover.

Opportunity Cost Analysis:

- Migration time investment: 6-9 months one-time

- Ongoing middleware limitations: Permanent constraint on product development

- Time currently spent working around middleware: Often equivalent to migration time investment

Phased Migration Benefits:

- Start with new customers on owned infrastructure

- Migrate existing customers gradually

- Reduce risk through controlled rollout

- Maintain business momentum throughout transition

Perspective on Investment:

You're already spending significant time working around middleware limitations, waiting for features, and managing vendor relationships. Migration is a concentrated investment that eliminates ongoing operational inefficiency.

"Direct Relationships Are Too Risky"

The Objection:

"What if something goes wrong without the middleware safety net? We don't want to be responsible for banking infrastructure failures."

The Risk Reality:

Middleware Doesn't Eliminate Risk—It Obscures It:

Hidden Risk with Middleware:

- Inherit their operational, compliance, and concentration risk

- No visibility into upstream problems until they affect you

- No control over their vendor relationships or strategic decisions

- Complete dependency on their business continuity planning

Transparent Risk with Direct Relationships:

- Full visibility into all system components and dependencies

- Direct relationships with all critical vendors

- Control over risk management and mitigation strategies

- Ability to diversify vendor relationships and reduce concentration risk

Risk Mitigation Through Ownership:

- Multiple processor relationships for redundancy

- Geographic diversification of critical infrastructure

- Direct control over business continuity planning

- Real-time monitoring of all system components

Regulatory Perspective:

Banking regulators increasingly view direct relationships as lower risk than middleware dependencies because of increased transparency and control.

The Informed Choice:

Direct relationships provide transparency that enables effective risk management. With middleware, you're blind to risks until they become customer-facing problems. With ownership, you can see risks developing and take proactive measures.

Insurance and Backup Planning:

- Comprehensive insurance coverage for direct infrastructure operations

- Detailed business continuity plans you control and test

- Vendor diversification to eliminate single points of failure

- Direct relationships with backup service providers

The Future of Financial Infrastructure

Market Trends Toward Ownership

The Shift Is Accelerating:

The fintech industry is experiencing a fundamental shift in infrastructure strategy. Leading companies are moving away from middleware dependency toward direct ownership, and this trend is accelerating for several converging reasons:

Regulatory Pressure:

- Increased scrutiny of third-party risk in banking partnerships

- Enhanced operational resilience requirements from federal regulators

- Clearer guidance favoring direct relationships over middleware arrangements

- Growing regulatory skepticism of concentration risk in middleware providers

Economic Reality:

- Middleware markup models become economically unsustainable at scale

- Direct relationships offer better unit economics and margin control

- Infrastructure ownership provides strategic pricing flexibility

- Cost transparency enables better financial planning and optimization

Technology Evolution:

- Cloud-native banking platforms reduce infrastructure complexity

- API-first architectures simplify integration and management

- DevOps automation makes infrastructure operations more accessible

- Modern compliance tools reduce regulatory burden

Competitive Pressure:

- Infrastructure ownership enables product differentiation

- Direct relationships allow faster feature development and deployment

- Owned infrastructure provides sustainable competitive advantages

- Market leaders are establishing infrastructure control as strategic priority

Leading Indicators We're Observing:

- Processor direct deal volume increasing 40%+ annually

- Bank partnership teams expanding to serve fintech relationships directly

- Venture capital firms prioritizing infrastructure ownership in investment criteria

- Executive talent movement toward companies with owned infrastructure strategies

Regulatory Evolution

Where Banking Regulation Is Heading:

Federal banking regulators are sending increasingly clear signals about their preferences for fintech infrastructure arrangements:

Enhanced Third-Party Risk Management:

- More stringent due diligence requirements for bank-fintech partnerships

- Increased scrutiny of vendor concentration risk in banking relationships

- Enhanced requirements for business continuity planning and operational resilience

- Greater emphasis on direct accountability for critical banking functions

Operational Resilience Focus:

- Requirements for redundant systems and backup capabilities

- Stress testing requirements for critical infrastructure dependencies

- Enhanced incident reporting and recovery planning requirements

- Greater focus on cyber security and data protection in vendor relationships

Direct Relationship Preferences:

Recent regulatory guidance consistently favors arrangements that provide:

- Clear lines of accountability and responsibility

- Direct oversight of critical banking functions

- Transparent risk management and reporting

- Reduced dependency on third-party service providers

Proactive Positioning:

Fintechs that build owned infrastructure today are positioning themselves ahead of the regulatory curve. When enhanced requirements are implemented, they'll already be compliant rather than scrambling to adapt.

Technology Evolution Enabling Ownership

Modern Infrastructure Advantages:

Cloud-Native Architecture:

- Scalable infrastructure that grows with business needs

- Geographic redundancy and disaster recovery built-in

- Cost optimization through usage-based pricing models

- Integration with modern development and operations tools

API-First Platforms:

- Standardized integration patterns across all system components

- Better documentation and developer experience than legacy systems

- Easier vendor switching and component replacement

- Future-proof architecture that adapts to new technologies

Microservices Design:

- Independent scaling of different system components

- Easier troubleshooting and performance optimization

- Reduced complexity compared to monolithic middleware systems

- Better alignment with modern software development practices

DevOps Automation:

- Automated deployment and configuration management

- Continuous integration and testing pipelines

- Real-time monitoring and alerting systems

- Infrastructure-as-code for consistent and repeatable deployments

Lowering Barriers to Entry:

Technology evolution has dramatically reduced the complexity and cost of infrastructure ownership. What required dozens of engineers and millions in infrastructure investment five years ago now requires a small, skilled team with the right platform choices.

Platform Thinking: The Strategic Advantage

Beyond Point Solutions:

The most successful fintechs of the next decade will be those that think in platform terms rather than single product terms. Infrastructure ownership enables platform economics that middleware dependency makes impossible.

Platform Economics Benefits:

- Cross-Sell Opportunities: Multiple products on shared infrastructure reduce unit costs

- Network Effects: Customer data and insights improve with scale

- Ecosystem Development: Third-party integrations and partnerships become possible

- Compounding Value: Each new capability enhances the value of existing capabilities

The Chisel Vision:

We believe the winning formula for fintech success is:

Infrastructure + Growth + Connections = Inevitable Success

1. Own Your Infrastructure (Control)

- Direct relationships with banks, processors, and networks

- Composable fintech infrastructure that adapts to your needs

- Data ownership and unlimited analytics capabilities

- Product development freedom and competitive differentiation

2. Master Your Growth (Acquisition)

- Marketing and customer acquisition optimized for your unit economics

- Customer experience fully under your control

- Data-driven optimization of acquisition and retention

- Brand building without vendor constraints

3. Build Your Ecosystem (Network Effects)

- Partnership networks that create value for customers

- Third-party integrations that extend your platform capabilities

- Marketplace dynamics that generate revenue and customer stickiness

- Network effects that create sustainable competitive advantages

The Platform Opportunity:

Infrastructure ownership isn't just about cost savings or risk reduction—it's about building the foundation for platform economics that create sustainable competitive advantage and long-term value creation.

Companies that understand this shift and act on it will dominate their markets. Companies that remain dependent on middleware will find themselves increasingly constrained and competitively disadvantaged.

Conclusion: Own Your Destiny

The middleware era served a purpose. It allowed fintechs to launch quickly without the complexity of building financial infrastructure from scratch. But the industry has matured, and the limitations of rented infrastructure have become clear.

Today's fundamental question isn't whether you can launch with middleware—it's whether you can scale, compete, and survive long-term without owning your infrastructure.

The Three Truths About Infrastructure Ownership:

1. Economic Truth

At meaningful scale, fintech infrastructure ownership is 40-60% cheaper than middleware dependency. The break-even point typically occurs within 24 months, followed by sustained cost advantages that compound over time.

2. Risk Truth

Direct banking relationships provide transparency that enables effective risk management. Middleware doesn't eliminate risk—it obscures it, creating hidden dependencies that can become existential threats.

3. Strategic Truth

Infrastructure ownership is sustainable competitive advantage. When you control your infrastructure, you control your product roadmap, customer experience, and strategic destiny.

The Time to Act Is Now

Recent industry challenges have created a window of opportunity. Banks are more open to direct fintech partnerships. Processors are competing for direct relationships. Modern technology has reduced the complexity of infrastructure ownership. Regulatory guidance favors direct accountability.

The best time to build infrastructure ownership was three years ago. The second best time is now.

Every day spent on middleware is money left on the table and strategic opportunity unnecessarily constrained. Every quarter of delay makes migration more complex and expensive.

Your Next Decision

The companies that will dominate the next decade of fintech aren't just building better products—they're building better foundations. They understand that infrastructure ownership isn't just operational improvement; it's strategic imperative.

Don't let infrastructure limitations define your ceiling. The future belongs to companies that own their destiny through owned infrastructure.

Ready to Explore Infrastructure Ownership?

We've guided dozens of fintechs through the migration to owned infrastructure. Our team understands the challenges because we've faced them ourselves. We know the opportunities because we've helped companies achieve them.

[Download: Infrastructure Ownership Assessment Framework]

Schedule a consultation to discuss your specific situation and learn how infrastructure ownership can transform your business.

[Request Infrastructure Assessment]

Frequently Asked Questions

Q: What transaction volume makes infrastructure ownership economically viable?

A: Generally $25M+ annually in processing volume makes the economics clearly favorable, though strategic considerations may justify earlier migration for fast-growing companies with clear path to scale.

Q: How long does migration from middleware to owned infrastructure take?

A: Typical timeline is 6-9 months from initial planning to full migration, with phased approaches that reduce risk and maintain business operations throughout the process.

Q: Can early-stage fintechs afford infrastructure ownership?

A: Early-stage companies often benefit from middleware simplicity to achieve initial market fit. Fast-growing companies ($10M+ revenue with clear scaling trajectory) should evaluate ownership seriously.

Q: What team size and expertise is needed for infrastructure ownership?

A: Minimum viable team includes 5-7 engineering resources plus dedicated compliance and operations expertise. Partnership with infrastructure specialists can reduce internal team requirements significantly.

Q: What happens to existing customers during the migration process?

A: With proper planning and parallel processing, customer experience remains seamless throughout migration. Phased migration approaches minimize any potential service disruption.

Q: Do I need my own banking charter to own infrastructure?

A: No. Direct Member Ownership means direct relationships with sponsor banks, processors, and card networks—not becoming a bank yourself or obtaining a charter.

Q: What are the biggest risks in migrating to owned infrastructure?

A: Primary risks include technical complexity, timeline overruns, and customer communication challenges. These risks are manageable with proper planning, experienced guidance, and phased execution.

Q: How do I choose the right banking partner for direct relationships?

A: Look for banks with demonstrated fintech partnership experience, clear compliance expectations, strong technical capabilities, and cultural alignment with your business strategy.

Q: Can I switch processors or other vendors later if needed?

A: Yes—this is a key advantage of composable fintech infrastructure. Modular architecture allows component swapping without complete system rebuilds.

Q: What compliance resources and capabilities are required?

A: Essential capabilities include dedicated compliance officer, comprehensive BSA/AML program, transaction monitoring systems, and regulatory audit capabilities. Requirements scale with transaction volume and product complexity.

Related Resources

Deep Dive Articles:

- BaaS vs. Infrastructure Ownership: Complete Comparison

- What Is Direct Member Ownership (DMO)? The Complete Guide

- How Much Does BaaS Really Cost? Hidden Fee Analysis

- Infrastructure Vendor Lock-In: How to Avoid It

Implementation Guides:

- How to Migrate from BaaS to Owned Infrastructure: Step-by-Step

- Composable Fintech Infrastructure: Building Blocks Guide

- Direct Banking Relationships: The Partnership Process

- Building vs. Buying Fintech Infrastructure: Decision Framework

Strategic Resources:

- Post-Middleware Infrastructure Options: Your Next Steps

- Infrastructure Ownership ROI Calculator and Financial Model

- FAQ: Infrastructure Ownership for Growing Fintechs

Latest Research:

- Download: State of Fintech Infrastructure 2026 Report

- Download: Infrastructure Ownership Assessment Framework

- Download: Migration Planning Template and Checklist

About the Author

Darin Petty, Co-Founder & CEO, Chisel

Darin has spent over a decade building financial infrastructure systems and has personally experienced both the promise and limitations of middleware models. Prior to founding Chisel, he co-founded BluBox, where he learned firsthand why infrastructure ownership provides sustainable competitive advantage over rented solutions.

At Chisel, Darin and his team are building the platform that enables fintechs to own their infrastructure without the traditional complexity, providing the Direct Member Ownership model that combines the control of ownership with the operational efficiency of modern platforms.

Darin's experience includes building compliance programs, negotiating processor relationships, managing banking partnerships, and scaling technical teams through rapid growth. His perspective comes from operating infrastructure at scale, not just theorizing about it.

Connect with Darin on LinkedIn

Published: January 2026 | Last Updated: January 2026

Reading Time: 14 minutes | Word Count: 3,542

Tags: #infrastructure ownership #fintech #direct member ownership #composable infrastructure #banking relationships #fintech platform